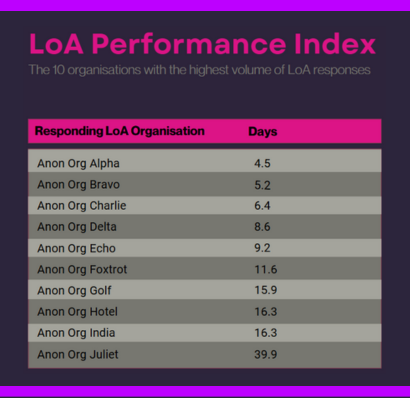

Pension Lab publishes and ranks the Letter of Authority (LoA) response times for its 10 highest-volume LoA-processing organisations.

Pension Lab’s LoA Performance Index (LPI), the first report of its kind, provides insights for organisations to benchmark their LoA processes against peers, helping them fulfil Consumer Duty responsibilities and prepare for increased volumes from Pensions Dashboards.

Pension Lab launches the first-ever Letter of Authority Performance Index (LPI) - a pivotal tool to help providers, platforms and pension schemes benchmark their LoA processing, drive collaboration and raise industry standards.

A LoA is a legal document enabling third parties, such as financial advisers, to request information on client plans and policies. Despite its essential role, the process is fraught with inefficiencies and security risks, often taking weeks or more to complete due to inconsistent formats, wet signature requirements and repeated chasing.

The LPI is based on data from thousands of LoAs processed monthly through Pension Lab’s digital LoA system, with over 230 different providers, platforms, master trusts and third-party administrators. It ranks the performance of the 10 highest-volume LoA-processing organisations anonymously, with response times ranging from an average of 4.5 days for the fastest to nearly 40 days for the slowest. By way of comparison, manual LoA processing timescales range from 9.6 days to 59.5 days1.

Scott Phillips, CEO and founder of Pension Lab, said:

“The LoA process underpins many essential transactions, including transfers, and its inefficiencies impact not just advice timescales but also providers' ability to deliver consolidation services to non-advised consumers.

“Fortunately, Pension Lab’s unique position enables critical insights into LoA performance, delays and their causes. Our LPI complements our broader initiatives like FLAG (Fix LoA Action Group) to help providers, master trusts, and platforms prioritise improvements that benefit Consumer Duty compliance and cost-savings, and importantly deliver improved servicing for advisers and consumers alike.

“Our digital LoA solution has processed same-day LoAs, so we know what is achievable, however, far too many LoAs drag on unnecessarily. To achieve industry-wide efficiency, we need to modernise requirements - eliminating wet signatures and paper formats – and act now for lasting improvements.”

Pension Lab has long championed improvements to the LoA process through initiatives such as the #LogYourLoAPain campaign, the white paper What Lies Beneath Letters of Authority, and the creation of the FLAG (Fix LoA Action Group) network. These efforts have brought attention to the significant costs and inefficiencies associated with LoAs, which currently impose an estimated annual cost of £442m across the sector. With pensions dashboards and increased consolidation expected to drive an eightfold increase in LoA volumes, addressing these inefficiencies has never been more urgent.

Pension Lab will publish the LPI quarterly, starting with Q3 2024 data, with Q4 2024 data to be published in February 2025.